Week 1

Audit & Game Plan

Upload your reports safely and meet with a certified strategist who maps every inaccurate, unverifiable, or outdated item to tackle first.

Dispute errors, organize your reports, and build healthy credit habits—without the guesswork.

Avg. score gain

+92

Median improvement after 4 months for active clients

Disputes resolved

21k

Combined inaccuracies successfully challenged this year

Portal logins

94%

Clients who say our progress tracking keeps them on pace

Consults booked

48h

Average time from inquiry to your first strategy session

What We Do

We combine certified credit analysts, modern automation, and clear coaching so you can resolve disputes faster and rebuild with confidence.

We carefully review your credit reports across all three bureaus to spot inaccuracies, outdated accounts, or unverifiable items.

Our dispute experts contact creditors and bureaus to challenge negative marks and ensure your record reflects accurate information.

Once errors are removed, we help you build positive credit with proven strategies and personalized guidance.

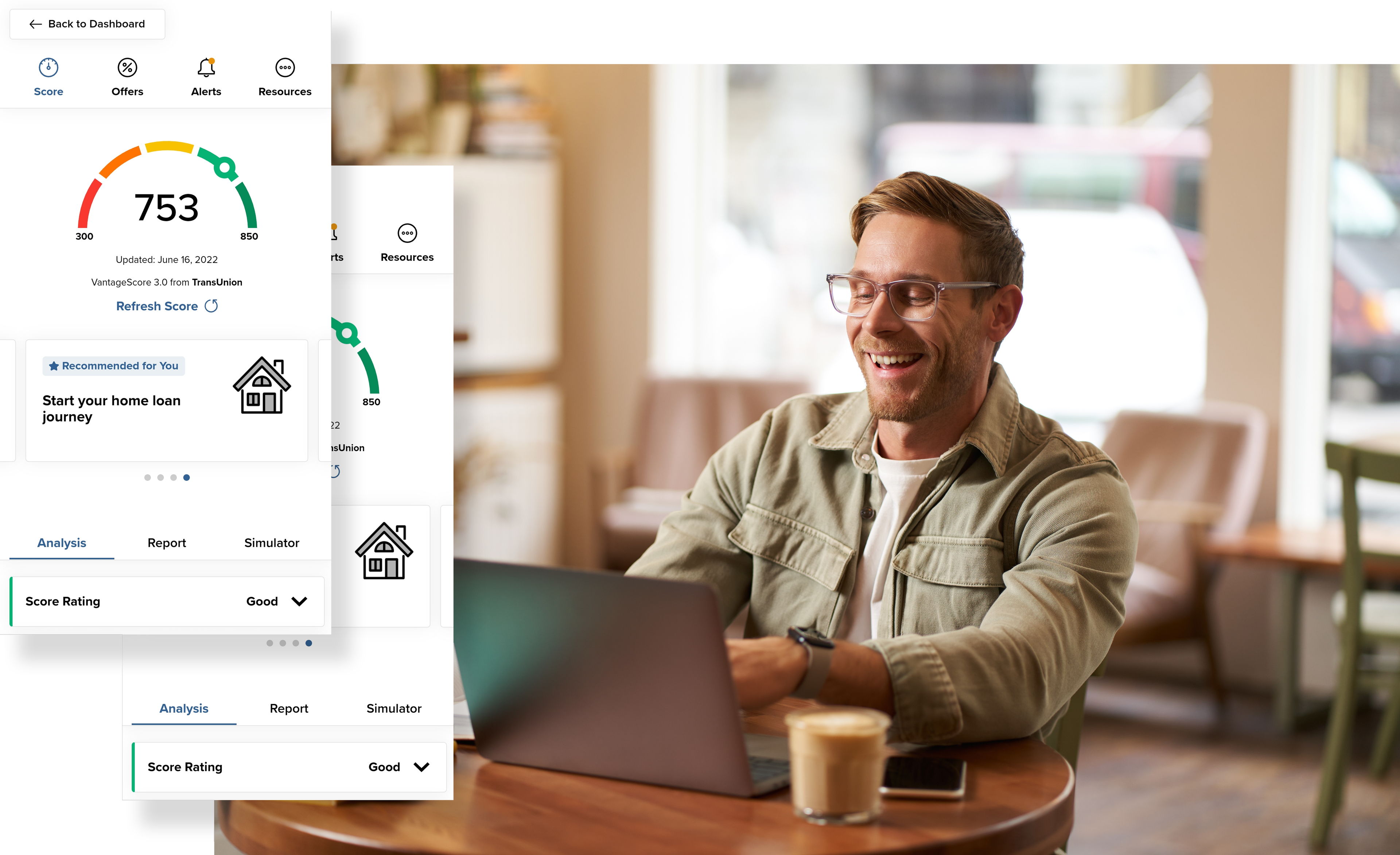

Your secure portal lets you monitor improvements and follow each step of your repair journey in real time.

No obligation. We uncover the fastest path to a stronger score.

Journey

Transparent milestones keep you confident. We handle the heavy lifting while your dashboard tracks every dispute, response, and score lift.

Week 1

Upload your reports safely and meet with a certified strategist who maps every inaccurate, unverifiable, or outdated item to tackle first.

Weeks 2-8

We coordinate bureau and creditor outreach with custom dispute letters, leveraging consumer protection laws tailored to your situation.

Weeks 4-16

Smart utilization, tradeline guidance, and reminders for the positive actions that deliver the biggest lift for your profile.

Ongoing

Graduation review sets you up with long-term score protection, refinancing game plans, and ongoing alerts in the Finova portal.

4.9 Average Rating

Angela R.

Los Angeles, CA

Finova helped remove two inaccurate collections and coached me on utilization. My score is up 92 points in 4 months.

Marcus D.

Phoenix, AZ

Transparent, no pressure, and real results. I finally qualified for my auto loan at a reasonable rate.

Sofia K.

Columbus, OH

The portal made it easy to track disputes. They explained every step so I actually understood my credit.

One-Time & Debt-Based Support

Tap targeted services for a specific collection, debt challenge, or upcoming loan. Fees scale with the work required—never a surprise.

$249 flat

Target a specific bureau error or collection with legal-backed dispute letters and follow-up coaching.

12% of resolved debt

For charge-offs or high balances impacting approval. We negotiate settlements and document compliance.

$599 flat

Designed with lenders for rapid score improvement when you are inside a mortgage underwriting window.

FAQ

We keep everything transparent. If there’s anything else you’d like to ask, reach out via chat inside the Finova portal.

Most members begin seeing meaningful score movement within 45-90 days. The full program timeline depends on the number of disputed items and how quickly bureaus respond, but our average engagement lasts 4-6 months.

Never. We work with the reports you securely upload or that you already have access to. Our portal uses encrypted storage so your information stays protected throughout the process.

Beyond disputes, we coach you on utilization, new tradelines, and debt payoff strategies that create lasting score changes. Each client has a dedicated success manager who updates you every step of the way.

Yes. We operate on a month-to-month membership with no long-term contracts. Cancel anytime by notifying your success manager or contacting support in the client portal.

Ready when you are

Bring your latest reports and we’ll map the first 90 days for you—free. See exactly how Finova would tackle your disputes before you commit.